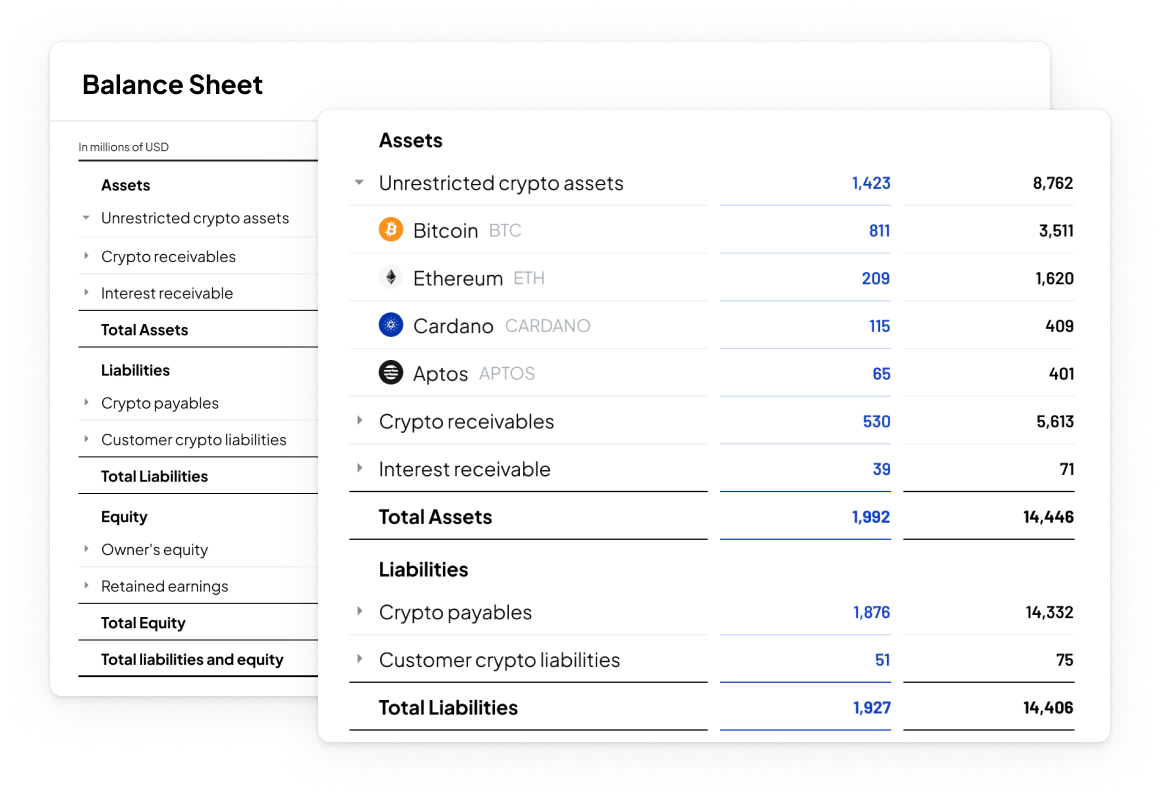

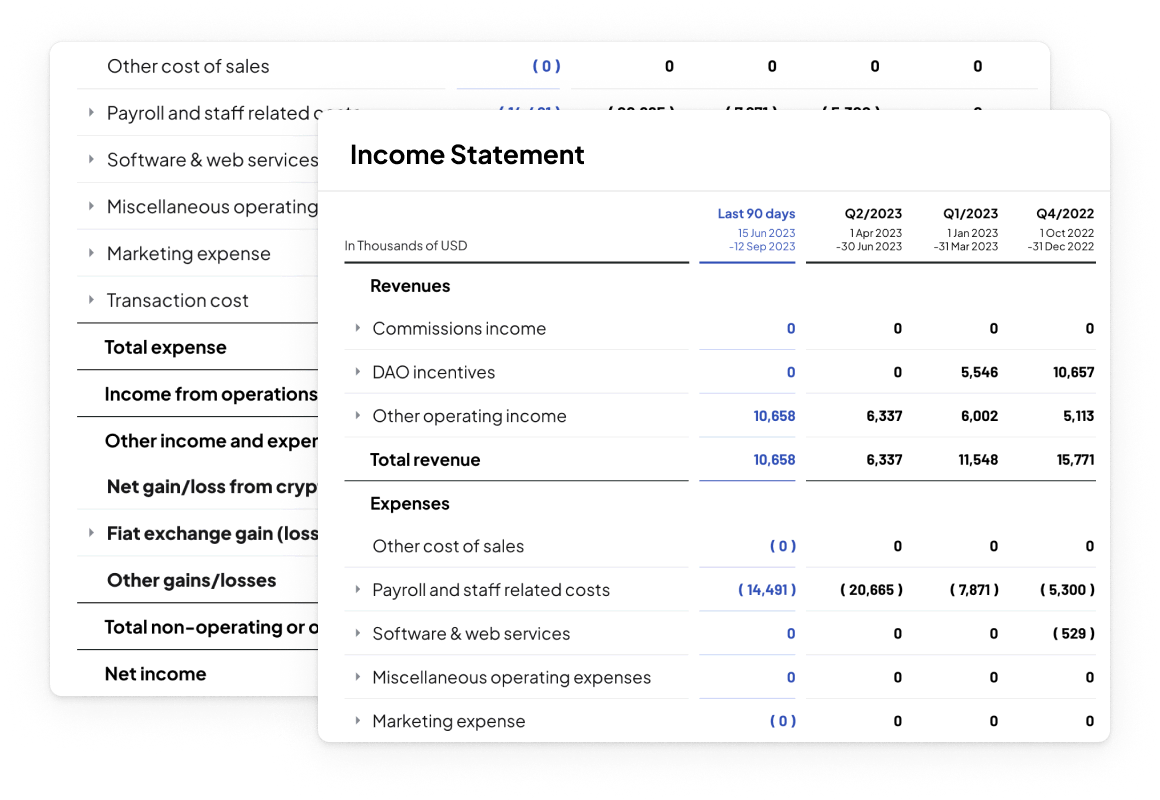

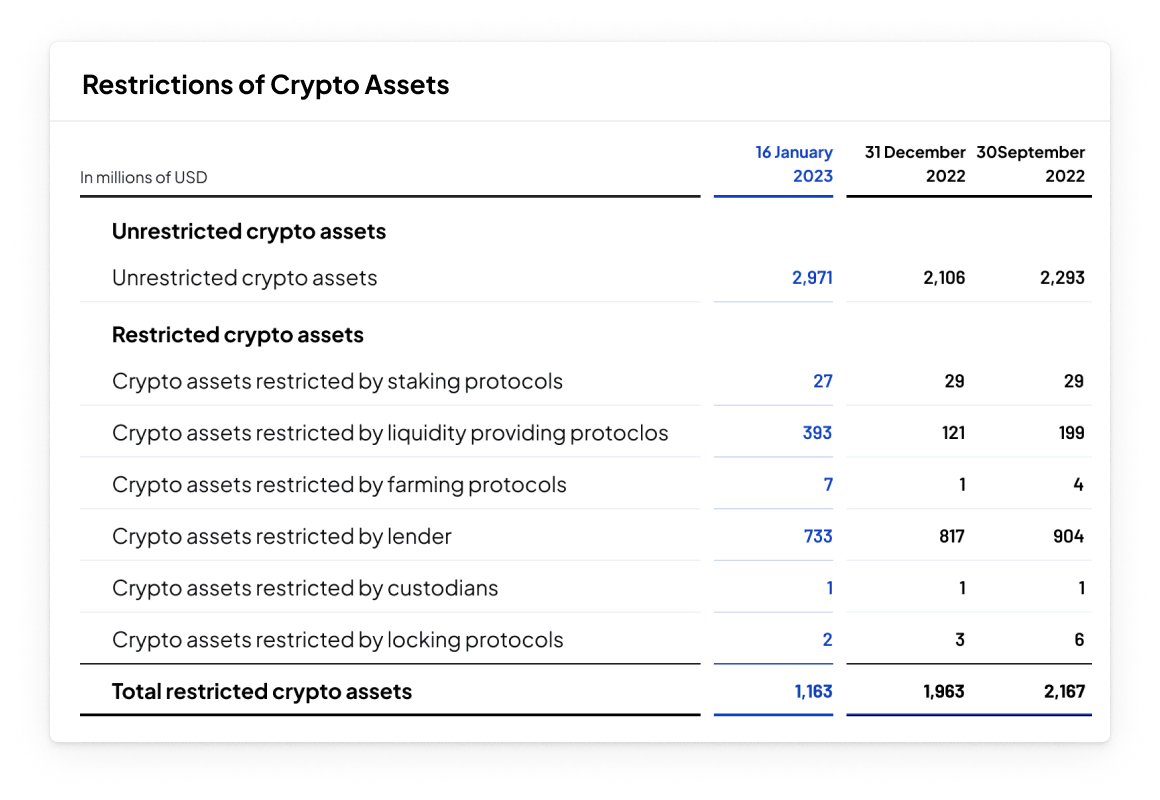

The new proposal from FASB requires that crypto assets be separated from a company's intangible assets in the balance sheet and disclosed separately at fair value measurement; in the income statement, changes in the fair value of crypto assets should be separately presented from changes in the carrying amount of other intangible assets. Although the new FASB proposal does not change the reporting requirements for cash flow statements, if crypto assets are used as non-cash intermediaries (for example, when transferring goods and services to customers to obtain crypto assets) during normal business processes and immediately exchanged for cash, they need to be reported as operating cash inflows.